UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x☒ Filed by a Party other than the Registrant ¨

Check the appropriate box:☐

| | | | | |

| | | | | Check the appropriate box: |

¨☐ | Preliminary Proxy Statement |

¨☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x☒ | Definitive Proxy Statement |

¨☐ | Definitive Additional Materials |

¨☐ | Soliciting Material under Rule 14a-12 |

|

| Trimble Inc. |

Trimble Inc. |

| (Name of registrant as specified in its charter) |

|

(Name of person(s) filing proxy statement, if other than the registrant): N/A |

|

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | |

x | No fee required. |

| ☐ | |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| |

¨ | | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

Transforming

The Way

TheWorld

Works

| | | | | | | | | | | | | | | | | |

| 2024 | |

| | | + | |

| | | | | |

| |

Transforming

the Way the

World Works

|

| | 2022 NOTICE OFANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT |

+

| |

| | | |

| | | | |

| | | | | |

| | |

Our MissionTrimble – Transforming the Way the World Works

|

For over 40 years, Trimble has developed industry-specificis a leading technology solutions provider that have helped customers achieve economic breakthroughs while enhancing productivity, boosting compliance,enables office and improving environmental sustainability. Through technological innovationmobile professionals to connect their workflows and asset lifecycles to drive a keenmore productive, sustainable future. With a focus on connecting the physicalindustries that feed, build, and digital worlds, we contribute end market value aimed at confronting important challenges such as feeding a growing global population, movingmove the goods of commerce efficiently,world, the comprehensive depth and optimizing next generation building and infrastructure for a better future. Our products are built with purpose and applied within a diverse array of major industries including agriculture, building construction, civil engineering, geospatial, transportation, government, forestry, electric and water utilities, and many others. Our portfolio is uniquely positioned to optimize operations while improving productivity through deep domain knowledge, innovation, and data-driven insights. By linking our own success with the successbreadth of our customers, employees, society, and the planet, we endeavor to transformsolutions is transforming the way the world works.works, making it easier for Trimble customers to focus on what matters—getting the job done right.

We innovate at the intersection of the digital and physical worlds with solutions that span the world’s foundational industries including building, civil and infrastructure construction, geospatial, survey and mapping, agriculture, natural resources, utilities, transportation, and government. We exist to empower our customers: asset owners, general and specialty contractors, engineers and designers, surveyors, agricultural companies and farmers, energy and utility companies, shippers and carriers of freight, as well as state, federal, and municipal governments. Productivity and sustainability are at the heart of who we are—it’s woven into our work internally and through our customers’ application of our technologies. The state of the world today requires us to adopt a strategic approach to the environmental, social, and governance (ESG) aspects of our business. We have reduced our impact on the environment, we have improved employee engagement, and we are committed to maintaining the highest levels of transparency. These efforts make us a better, more resilient company and motivate us to continue innovating, so our customers and stakeholders can work better, safer, faster, cheaper and greener. |

TRIMBLE INC.

Notice of Annual Meeting of Stockholders

| | | | | | | | | | | |

| | | |

| | | |

| When: | Where: | Who Can Vote: | Items of Business: |

WednesdayThursday, May 30, 2024 | Virtually via the internet at

| Stockholders of record at the close of business on: | Three proposals, as listed below |

May 25, 2022 | www.virtualshareholdermeeting.com/TRMB2022 |

at 5:00 p.m. PacificMountain time | www.virtualshareholdermeeting.com/TRMB2024 |

| Online check-in: 4:45 p.m. Mountain time | | March 28, 2022 | April 1, 2024 |

The following itemsItems of business will be voted on at the 2022 annual meeting of stockholders (“Annual Meeting”) of Trimble Inc. (the “Company”):Business and Board Voting Recommendations

1. To elect directors to serve for the ensuing year and until their successors are elected. | | | | | | | | |

| 1 | Election of directors | FOR each of the nominees |

| 2 | Advisory vote to approve executive compensation (“Say on Pay”) | FOR |

| 3 | Ratification of appointment of independent registered public accounting firm | FOR |

| 4 | Approval of amendments to the 2002 Stock Plan | FOR |

2. To hold an advisory vote on approving the compensation for our Named Executive Officers.Your Vote is Important

3. To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for the current fiscal year ending December 30, 2022.

YOUR VOTE IS IMPORTANT. All stockholders are cordially invited to attend the Annual Meeting via the internet. In light of the ongoing coronavirus pandemic and in consideration of the health and well-being of our employees and stockholders, we will only be hosting the Annual Meeting via live webcast on the internet. Any stockholder can listen to and participate in the Annual Meeting live via the internet at www.virtualshareholdermeeting.com/TRMB2022. Stockholders may vote and ask questions while connected to the Annual Meeting on the internet. You will not be able to attend the Annual Meeting in person. Instructions on how to participate in the Annual Meeting and demonstrate proof of stock ownership are posted at www.virtualshareholdermeeting.com/TRMB2022. The webcast of the Annual Meeting will be archived for one year after the date of the Annual Meeting at www.virtualshareholdermeeting.com/TRMB2022.internet link shown above. However, to ensure your representation at the meeting, you are urged to vote in advance of the meeting via the internet or by telephone or, if you requested to receive printed proxy materials, by mailing a proxy.

On approximately April 12, 2022, weA notice of internet availability of proxy materials containing instructions on how to vote and how to access our Annual Meeting materials, including our proxy statement, our annual report and proxy card was mailed to our stockholders (other than those who previously requested electronic delivery or full printed materials) aon approximately April 16, 2024. The notice of internet availability of proxy materials (“Notice”) containing instructions on how to access our Annual Meeting materials, including our proxy statement, our annual report and proxy card. The Notice also included instructions on how to receive a paper copy of our Annual Meeting materials.materials, which include this notice of annual meeting and proxy statement and our annual report on Form 10-K. If you received a paper copy of our Annual Meeting materials by mail, the notice of Annual Meeting, proxy statement, anda proxy card from our Board of Directors werewas also enclosed. If you received your Annual Meeting materials via e-mail, the e-mail contained voting instructions and links to the notice and proxy statement and our annual report and the proxy statement on the internet, which are both also available at investor.trimble.com/annuals-and-proxies.

For the Board of Directors,

Executive ChairmanBörje Ekholm, Chairperson of the Board

April 12, 202216, 2024

TRIMBLE INC.

Proxy Statement

for the 2024 Annual Meeting of Stockholders

Table of Contents

| | Introduction | Introduction | | Executive Compensation | |

| Information Regarding the Meeting | Information Regarding the Meeting | | | Compensation Discussion and Analysis | |

Internet Availability of Proxy Materials | | | Business Highlights | |

Information Concerning Solicitation and Voting | | | Overview of Executive Compensation | |

| Deadline for Receipt of Stockholder Proposals for 2023 Annual Meeting | | | Details of 2021 Executive Compensation | |

| Compensation Committee Report | |

| | |

| | | | | | | |

| Executive Overview | Executive Overview | | | Executive Compensation Tables | | | | | | | | |

Voting Matters | | | Summary Compensation Table | |

Our Mission | | | Grants of Plan-Based Awards | |

| | | | | | | | | |

Company Performance Highlights | Company Performance Highlights | | | Outstanding Equity Awards at Fiscal Year End | | | | | | | | |

Our Strategy for Sustainability | Our Strategy for Sustainability | | | Option Exercises and Stock Vested | | | | | | | | |

Our Culture and People | Our Culture and People | | | Deferred Compensation | | | | | | | | |

Corporate Governance Highlights | Corporate Governance Highlights | | | Post-Employment Compensation | | | | | | | | |

Executive Compensation Philosophy, Policies and Practices | Executive Compensation Philosophy, Policies and Practices | | | Potential Payments upon Termination or a Change in Control | | | | | | | | |

| | | | | | | | | | | |

Stockholder Engagement | Stockholder Engagement | | | Trimble Age & Service Equity Vesting Program | | | | | | | |

| Death Benefits | |

| | | | | | | | | | | | | |

| Proposals | Proposals | | CEO Pay Ratio | | Proposals | | | | | |

| Item 1. Election of Directors | Item 1. Election of Directors | | | | | | | | | |

Vote Required | | | Other Information | |

Recommendation of the Board of Directors | | | Audit Committee Report | |

| Item 2. Advisory Vote on Executive Compensation | | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Vote Required | | |

Recommendation of the Board of Directors | | | Security Ownership of Certain Beneficial Owners | |

| | |

| | | | |

| | | | |

| | | | | |

| Item 3. Ratification of Appointment of Independent Registered Public Accounting Firm | Item 3. Ratification of Appointment of Independent Registered Public Accounting Firm | | | Security Ownership of Management | | | | | | | | |

| Equity Compensation Plan Information | |

Vote Required | | | Delinquent Section 16(a) Reports | |

Recommendation of the Board of Directors | | | Certain Relationships and Related Transactions | |

| | | | | | | | | | |

| | | | | | | | |

| | Householding | |

| | | | Other Information | |

| | | | Other Information | |

| | | | Other Information | |

| Board Matters | |

| Board Matters | |

| Board Matters | Board Matters | | Other Matters | | | | | | |

| Board Meetings and Committees; Director Independence | Board Meetings and Committees; Director Independence | | | | | | | | | |

| Appendices | |

| | | |

| | |

Stockholder Communications with Directors | Stockholder Communications with Directors | | | Appendix A: Reconciliation of GAAP to non-GAAP Financial Measures | | | | | | |

Board Leadership Structure; Oversight and Risk Management | Board Leadership Structure; Oversight and Risk Management | | | | | | | | | |

| | | | | | | | | | | |

Committee Membership | Committee Membership | | | | | | | | |

Audit Committee | Audit Committee | | | | | | | | | |

Compensation Committee | | |

| | | | | | | | | |

Nominating and Corporate Governance Committee | Nominating and Corporate Governance Committee | | | | | | | | | |

| | | | | | | | | |

| Non-Employee Director Compensation | Non-Employee Director Compensation | | | | | | | | | |

Non-Employee Director Compensation Table | | |

| | |

Non-Employee Director Stock Ownership Guidelines | Non-Employee Director Stock Ownership Guidelines | | |

| | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

| | | | | | | |

| | | | | | |

| | | | | | | |

|

INFORMATION REGARDING THE MEETING

The enclosed proxy is solicited on behalf of the board of directors (“Board of Directors” or “Board”) of Trimble Inc., a Delaware corporation (“Trimble” or the “Company”), for use at the Company’s annual meeting of stockholders (“Annual Meeting”), to be held live via the internet, on Wednesday, May 25, 2022,30, 2024, at 5:00 p.m. PacificMountain time, and at any adjournment(s) or postponement(s) thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The record date for the Annual Meeting is April 1, 2024.

You will not be able to attend the Annual Meeting in person. Any stockholder can listen to and participate in the Annual Meeting live via the internet at www.virtualshareholdermeeting.com/TRMB2022.TRMB2024. Our Board of Directors annually considers the appropriate format of our annual meeting. In light of the ongoing coronavirus (“COVID-19”) global pandemic and in consideration of the health and well-being of our employees and stockholders,2024, we will only be hosting the Annual Meeting via live webcast on the internet. Hosting the Annual Meeting via the internet also provides expanded access, improved communication, reduced environmental impact and cost savings for our stockholders and the Company. Hosting a virtual meeting also enables increased stockholder attendance and participation since stockholders can participate and ask questions from any location around the world, and provides us an opportunity to give thoughtful responses. In addition, we intend that the virtual meeting format provide stockholders a similar level of transparency to the traditional in person meeting format and we take steps to ensure such an experience. Our stockholders will be afforded the same opportunities to participate at the virtual Annual Meeting as they would at an in person annual meeting of stockholders.

Our virtual Annual Meeting allows stockholders to submit questions and comments during the meeting. After the meeting, we will spend up to 15 minutes answering stockholder questions that comply with the meeting rules of conduct; the rules of conduct will be posted on the virtual meeting web portal. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

The Annual Meeting webcast will begin promptly at 5:00 p.m. PacificMountain time. We encourage you to access the Meeting webcast prior to the start time. Online check-in will begin, and stockholders may begin submitting written questions, at 4:45 p.m. PacificMountain time, and you should allow ample time for the check-in procedures.

Principal Executive Offices

The Company’s principal executive offices are located at 935 Stewart Drive, Sunnyvale, California 94085. The telephone number at that address is (408) 481-8000.

Annual Report on Form 10-K

A copy of the Company’s annual report on Form 10-K may be obtained by sending a written request to the Company’s Investor Relations Department at 935 Stewart Drive, Sunnyvale, California 94085. Full copies of the Company’s annual report on Form 10-K for the 2021 fiscal year, and proxy statement, each as filed with the Securities and Exchange Commission (“SEC”) are available via the internet at the Company’s web site at investor.trimble.com/annuals-and-proxies.

Information Referenced in this Proxy Statement

The content of the websites referred to in this proxy statement are not deemed to be part of, and are not incorporated by reference into, this proxy statement.

Internet Availability of Proxy Materials

Under the “notice and access” rules adopted by the SEC, we are furnishing proxy materials to our stockholders primarily via the internet, instead of mailing printed copies of those materials to each stockholder. As a result, on or about April 12, 2022, we mailed our stockholders a notice of internet availability of proxy materials (“Notice”) containing instructions on how to access our proxy materials, including our proxy statement and our annual report. The Notice also instructs you on how to access your proxy card to vote through the internet or by telephone. The Notice is not a proxy card and cannot be used to vote your shares.

This process is designed to expedite stockholders’ receipt of proxy materials, lower the costwebcast of the Annual Meeting and help minimize the environmental impact of the Annual Meeting. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice. If you have previously

Proxy Statement for the 2022 Annual Meeting of Stockholders | Trimble 1

elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

Information Concerning Solicitation and Voting

Record Date and Shares Outstanding

Stockholders of record at the close of business on March 28, 2022 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting. At the Record Date, the Company had issued and outstanding 250,370,225 shares of common stock, $0.001 par value (“Common Stock”). A list of stockholders entitled to vote at the Annual Meeting is expected to be available for examination at our principal executive offices at the address listed above for a period of 10 days prior to the Annual Meeting, and during the Annual Meeting such list will be availablearchived for examination at www.virtualshareholdermeeting.com/TRMB2022 by using the 16-digit control number included on your Notice or your proxy card or voting instruction form (if you received a printed copy of the proxy materials) or included in the email to you if you received the proxy materials by email.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Company (Attn: Corporate Secretary) a written notice of revocation or a duly executed proxy bearing a later date (including a proxy by telephone or over the internet) or by attending the meeting and voting live via the internet at www.virtualshareholdermeeting.com/TRMB2022. Attendance at the virtual meeting will not, by itself, revoke a proxy.

Solicitation of Proxies

The entire cost of this proxy solicitation will be borne by the Company. The Company has retained the services of Morrow Sodali LLC, 333 Ludlow Street, 5th Floor, South Tower, Stamford, CT 06902, to solicit proxies, for which services the Company has agreed to pay approximately $8,000 as well as a solicitation charge per stockholder in the event individual holders are solicited. In addition, the Company will also reimburse certain out-of-pocket expenses in connection with such proxy solicitation. The Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding soliciting materials to such beneficial owners. Proxies may also be solicited by certain of the Company’s directors, officers, and regular employees, without additional compensation, personally or by telephone, or facsimile.

Voting

Each share of Common Stock outstanding on the Record Date is entitled to one vote on all matters. An automated system administered by the Company’s agent tabulates the votes.

Abstentions and broker non-votes are each included in the determination of the presence or absence of a quorum at the Annual Meeting. The required quorum is a majority of the shares outstanding on the Record Date. Abstentions and broker non-votes will be taken into account only for purposes of determining whether a quorum is present, and will not be taken into account in determining the outcome of any of the items submitted to a vote of the stockholders.

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular item because the nominee does not have discretionary voting power with respect to that item and has not received instructions with respect to that item from the beneficial owner, despite voting on at least one other item for which it does have discretionary authority or for which it has received instructions. If your shares are held by your broker, bank or other agent as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker, bank or other agent to vote your shares. If you do not give instructions, under the rules that govern brokers who are record owners of shares that are held in street name for the beneficial owners of the shares, brokers who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on routine matters but have no discretion to vote them on non-routine matters. Item 3 is a routine matter. Items 1 and 2 are non-routine matters.

A plurality of the votes cast will determine Item 1 (see “Item 1 – Election of Directors”). However, since this is an uncontested election of directors, if any nominee for director in this election receives a greater number of votes “withheld” from such nominee than votes “for”, the nominee for director must tender his or her resignation to our

2 Trimble | Proxy Statement for the 2022 Annual Meeting of Stockholders

Board of Directors, and within 90 days followingyear after the date of the Annual Meeting the remaining members of our Board of Directors shall, through a process managed by the Nominating and Corporate Governance Committee and excluding the director nominee in question, determine whether to accept such resignation. Items 2 and 3 require the affirmative vote of the holders of the majority of the shares represented and voting at the Annual Meeting live via the internet at www.virtualshareholdermeeting.com/TRMB2022 or by proxy on such item.

Voting via the Internet or by Telephone

Stockholders may vote by submitting proxies electronically either via the internet or by telephone or, if they request paper copies of the proxy materials, they may complete and submit a paper version of the proxy card. Please note that there are separate arrangements for voting via the internet and by telephone depending on whether shares are registered in the Company’s stock records directly in a stockholder’s name or whether shares are held in the name of a brokerage firm or bank. Detailed electronic voting instructions can be found on the Notice mailed to each stockholder.

In order to allow individual stockholders to vote their shares and to confirm that their instructions have been properly recorded, the internet and telephone voting procedures have been designed to authenticate each stockholder’s identity. Stockholders voting via the internet should be aware that there may be costs associated with electronic access, such as usage charges from internet access providers and telephone companies that will be borne solely by the individual stockholder. If you submit a proxy via the internet or by telephone, you do not need to return your proxy card.

Voting During the Virtual Annual Meeting

You will need the 16-digit control number included on your Notice or your proxy card or voting instruction form (if you received a printed copy of the proxy materials) or included in the email to you if you received the proxy materials by email in order to be able to vote your shares or submit questions during the Annual Meeting. Instructions on how to connect to the Annual Meeting and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/TRMB2022. If you do not have your 16-digit control number, you will be able to access and listen to the Annual Meeting but you will not be able to vote your shares or submit questions during the Annual Meeting.

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting or submitting questions. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page.

Registered Stockholders

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Co., Inc., you are considered to be the registered stockholder with respect to those shares. A Notice for registered stockholders was mailed directly to you by our mailing agent, Broadridge Investor Communications, Inc. Registered stockholders have the right to vote live via the internet at

www.virtualshareholdermeeting.com/TRMB2022.

Beneficial Stockholders

If your shares are held in a brokerage account or by another nominee, you are considered to be a beneficial stockholder of those shares. A Notice for beneficial stockholders was forwarded to you together with voting instructions. In order to vote via the internet at the Annual Meeting, beneficial stockholders must obtain a “legal proxy” from the broker, trustee or nominee that holds their shares. Without a legal proxy, beneficial owners will not be allowed to vote live via the internet at www.virtualshareholdermeeting.com/TRMB2022.

Deadline for Receipt of Stockholder Proposals for 2023 Annual Meeting

Stockholders are entitled to present proposals for action at future stockholder meetings of the Company if they comply with the requirements of the appropriate proxy rules and regulations promulgated by the SEC.

Proposals of stockholders which are intended to be considered for inclusion in the Company’s proxy statement and form of proxy related to the Company’s 2023 annual meeting of stockholders must be received by the Company at its principal executive offices (Attn: Corporate Secretary – Stockholder Proposals, Trimble Inc. at 935 Stewart Drive, Sunnyvale, California 94085) no later than December 13, 2022. Stockholders interested inTRMB2024.

Proxy Statement for the 20222024 Annual Meeting of Stockholders | Trimble 3

submitting such a proposal are advised to retain knowledgeable legal counsel with regard to the detailed requirements of the applicable securities laws. The timely submission of a stockholder proposal to the Company does not guarantee that it will be included in the Company’s applicable proxy statement.

Stockholders who wish to offer proposals at the Annual Meeting will be required to send notice to the Company with information concerning the proposal, the stockholder giving such notice, and any beneficial owner on whose behalf the proposal is made, as specified in the bylaws, which notice in order to be timely must be received by the Company not earlier than January 25, 2023 and not later than February 24, 2023, except if the annual meeting for 2023 is called for a date earlier than April 25, 2023 or later than June 24, 2023, notice by the stockholder in order to be timely must be so received not later than the close of business on the tenth (10th) day following the day on which notice of the date of the annual meeting for 2023 is mailed or the date the Company announces the date of the annual meeting for 2023, whichever occurs first. The proxy holders for the Company’s 2023 annual meeting of stockholders will have the discretionary authority to vote against any stockholder proposal that is not timely if it is properly raised at such annual meeting, even though such stockholder proposal is not discussed in the Company’s proxy statement related to that stockholder meeting.

Stockholders who wish to nominate one or more candidates for election as a director will be required to send notice to the Company with the information and undertakings concerning the nominee, the stockholder giving such notice, and any beneficial owner on whose behalf the nomination is made, as specified in the bylaws, which notice in order to be timely must be received by the Company not earlier than January 25, 2023 and not later than February 24, 2023, except if the annual meeting for 2023 is called for a date earlier than April 30, 2023 or later than June 19, 2023, notice by the stockholder in order to be timely must be so received not later than the close of business on the tenth (10th) day following the day on which notice of the date of the annual meeting for 2023 is mailed or the date the Company announces the date of the annual meeting for 2023, whichever occurs first.

The proxy card provided in conjunction with this proxy statement, to be used in connection with the 2022 Annual Meeting, grants the proxy holder discretionary authority to vote on any matter otherwise properly raised at such Annual Meeting.

4 Trimble | Proxy Statement for the 2022 Annual Meeting of Stockholders 1

EXECUTIVE OVERVIEW

2022 Annual Meeting of Stockholders

DATE AND TIME: May 25, 2022, 5:00 p.m. Pacific time

PLACE: Virtually via the internet at www.virtualshareholdermeeting.com/TRMB2022

RECORD DATE: March 28, 2022

This overview highlights information about the Company, including certain information contained elsewhere in this proxy statement, but does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting. For more complete information regarding the Company’s performance in fiscal 2021 performance,year 2023 (“fiscal 2023” or “2023”), please review the Company’s Annual Reportannual report on Form 10-K for the year ended December 31, 2021.29, 2023.

Voting MattersOur Business

| | | | | | | | |

Proposal | Description | Board Recommendation |

Proposal 1: | To elect directorsDedicated to serve for the ensuing year and until their successors are elected | FOR |

Proposal 2: | To hold an advisory vote on approving the compensation for our Named Executive Officers | FOR |

Proposal 3: | To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for the current fiscal year ending December 30, 2022 | FOR |

Our Mission – Transforming the Way the World Works

For over 40 years,world's tomorrow, Trimble has developed industry-specificis a technology company delivering solutions that have helpedenable our customers achieve economic breakthroughs while enhancing productivity, boosting compliance,to work in new ways to measure, build, grow and improving environmental sustainability. Through technological innovation and a keen focus on connecting the physical and digital worlds, we contribute end market value aimed at confronting important challenges such as feeding a growing global population, moving themove goods of commerce efficiently, and optimizing next generation building and infrastructure for a better future. Ourquality of life. Core technologies in positioning, modeling, connectivity and data analytics connect the digital and physical worlds to improve productivity, quality, safety, transparency and sustainability. From purpose-built products are built with purpose and applied within a diverse arrayenterprise lifecycle solutions to industry cloud services, Trimble is transforming critical industries such as construction, geospatial, agriculture and transportation to power an interconnected world of major industries including agriculture, building construction, civil engineering, geospatial, transportation, government, forestry, electric and water utilities, and many others. Our portfolio is uniquely positioned to optimize operations while improving productivity through deep domain knowledge, innovation, and data-driven insights. By linking our own success with the success of our customers, employees, society, and the planet, we endeavor to transform the way the world works.work.

Proxy Statement for the 2022 Annual Meeting of Stockholders | Trimble 5

Company Performance Highlights

Fiscal 2021 presented many global challenges similar to those experienced in fiscal 2020, but it also presented new opportunities. The global pandemic caused by COVID-19,2023

Our core strategy, Connect & Scale, involves digitally connecting the workflows within targeted industry segments and the related supply chain disruptions, affected almost all of the markets thatcreating scale across Trimble through shared technology platforms. In 2023, we serve. Despite the macroeconomic and supply chain challenges, we achieved record levels of annualized recurring revenue, revenue, profit, earnings per share and operating cash flow. We continued to advance our Connect and Scale 2025this strategy, investing in people, process, and technology. We divested a number of businesses that are not core to our Connect & Scale strategy, and we acquired companies that will accelerate our Connect & Scale strategy, including Transporeon. We also continued to develop the competitive strengths of our core businesses, while focusing on a healthy balance for our business portfolio with respect to end marketend-market exposure, geographic diversity, and business model mix. Our ongoing strategy is to connect stakeholders across industry lifecycles

We achieved a record level of annualized recurring revenue (“ARR”) in 2023 and to transform customer workflows.

increased our gross profit margin. We finished 2021the year with software, services, and recurring revenues representing 55%67% of total Company revenue. We reached $1.41$1.98 billion in annualized recurring revenueARR in the fourth quarter of the year, up 9%24%, or 13% on an organic basis, compared to the fourth quarter of the prior year. Compared to 2020,2022, total revenue grew 16%3%, net income was up 26%or 1% organically, GAAP gross margin rose from 57.3% to 61.4%, and adjusted EBITDA was up 17%non-GAAP gross margin rose from 60.0% to 64.7%. We repurchased $100 million of common stock in 2023. See Appendix A to this proxy statement for definitions of annualized recurring revenue and organic revenue growth and a reconciliation of GAAP to non-GAAP numbers.

2 Trimble | Proxy Statement for the 2024 Annual Meeting of Stockholders

Financial highlights for fiscal 2021 included (comparisons are to prior year unless stated otherwise):2023 included:

| | | | | | | | | | | |

| 2023 | Change vs. 2022 | | | | | | | | | | Notes |

| Total revenue | $3.80 billion | $3.66 billion

p 3%

| ▲ 16%

| organicOrganic growth ▲ 16%p 1%

|

| Software, services and recurring revenue | 55%67%

of total revenue | pvs. 59% in prior year | |

| Annualized recurring revenue | $1.411.98 billion for the fourth quarter | ▲ 9%p 24% compared to fourth quarter of prior year

|

|

Net income | $493 million

GAAP net income

| ▲ 26%

| 13.5% as a %Organic growthp13%compared to fourth quarter of revenue

vs. 12.4% in prior year

|

| $677 million

non-GAAP net income

| ▲ 20%

| 18.5% as a % of revenue

vs.17.8% in prior year

|

Adjusted EBITDA | $937million

| ▲ 17% | 25.6% as a % of revenue

vs. 25.3% in prior year

|

| Operating income | $561449 million GAAP operating income | ▲ 34%

q 12%

| 15.3%11.8% as a % of revenue

vs. 13.3%13.9% in prior year |

| $857935 million non-GAAP operating income | ▲ 19%

p 11%

| 23.4%24.6% as a % of revenue

vs. 22.8%22.9% in prior year |

| Adjusted EBITDA | $1.01 billion | p 10% | 26.6% as a % of revenue vs. 25.0% in prior year |

| | | |

| | | |

| Net income | $311 million GAAP | q 31% | 8.2% as a % of revenue vs. 12.2% in prior year |

| $664 million non-GAAP | p 1% | 17.5% as a % of revenue vs.18.0% in prior year |

| Diluted net income per share | $1.941.25 GAAP diluted net income per share | q vs. $1.551.80 in prior year | |

| $2.66 non-GAAP diluted net income per share | p vs. $2.232.64 in prior year | |

| Operating cash flow | $751597 million | ▲ 12%

p vs. $391 million in prior year

| | $180 million

Repurchase of common stock repurchased | $100 million | | $395 million in 2021prior year |

See Appendix A to this proxy statement for a reconciliation of GAAP to non-GAAP financial measures, including operating income and an explanationnet income (as also used in the computation of the performance measure “annualizeddiluted net income per share), along with definitions of organic revenue growth, annualized recurring revenue.”

6 Trimble | Proxy Statement for the 2022 Annual Meeting of Stockholders

revenue, and adjusted EBITDA.Long-term performance

Trimble has an excellent recordSince 2013, Trimble’s revenue, annualized recurring revenue, GAAP operating income, and adjusted EBITDA have grown at compound annual growth rates of performance5%, 13%, 6%, and creating stockholder value7%, respectively, illustrating the company’s long-term growth trajectory over an extended period of time,time.

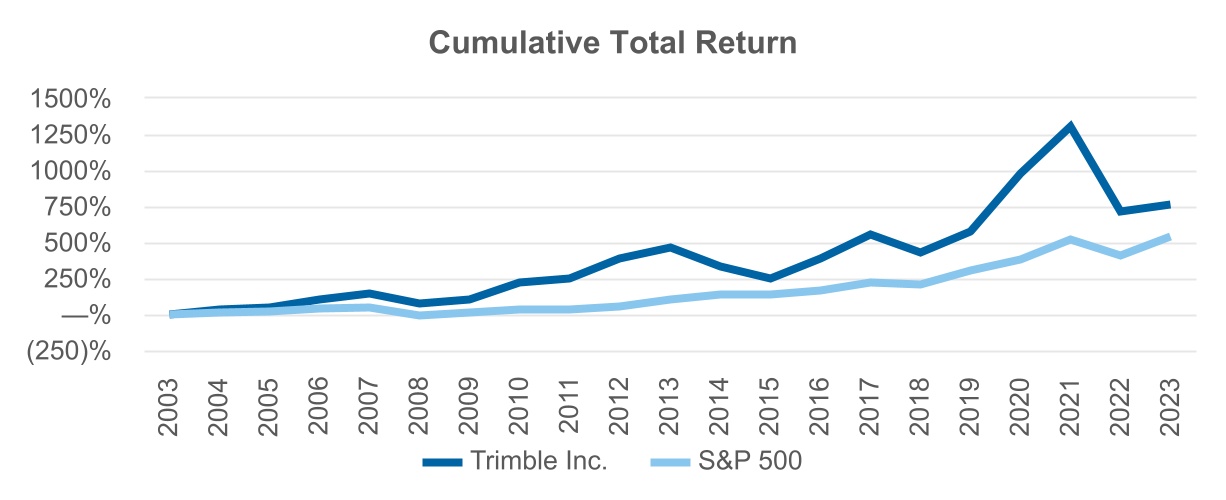

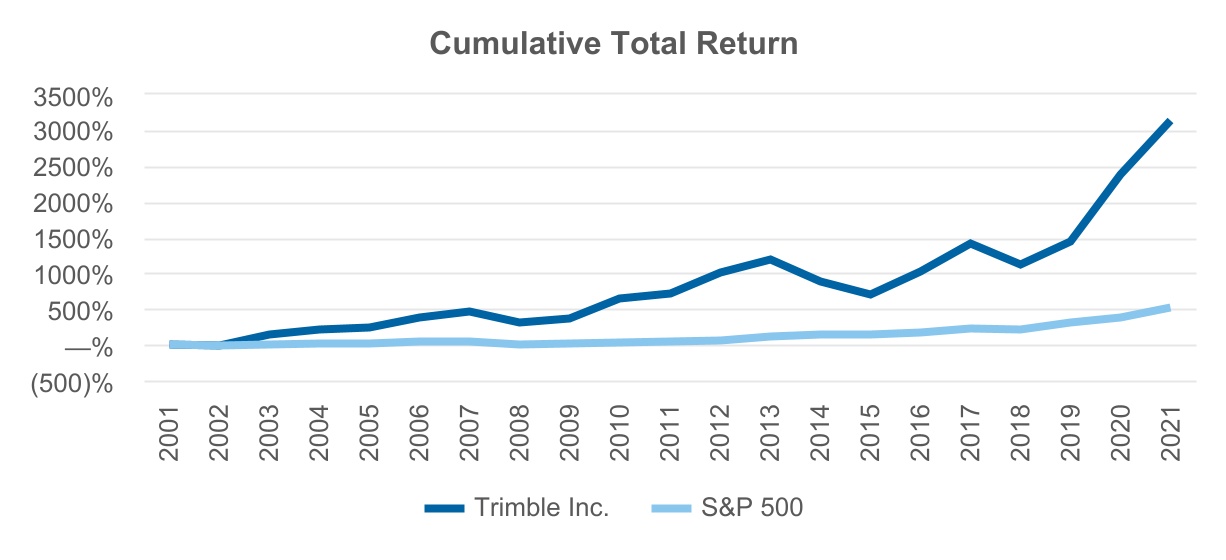

Also, as shown in the following chart of average annual increase in stock price:

| | | | | | | | | | | | | | | | | | | | |

| 1 year | 3 years | 5 years | 10 years | 15 years | 20 years |

| Trimble | 30.6% | 38.4% | 23.7% | 14.9% | 13.7% | 19.0% |

| S&P 500 (TR) | 28.7% | 26.1% | 18.5% | 16.5% | 10.7% | 9.5% |

Trimble’s total return over multiple time periods within the 20-year time horizon illustrates the long-term out‑performance through economic cycles.

graph below, Trimble's cumulative total return has also significantly outperformed the S&P 500 over the 20-year time horizon, as shown inhorizon.

Proxy Statement for the graph below.2024 Annual Meeting of Stockholders | Trimble 3

Long-term growth strategy

In 2020, we initiated TrimbleElements. Our growth strategy is centered on multiple elements:

Our Connect and& Scale, a strategy. We continue to focus on executing our multi-year platform growth strategy. This strategy, which contains two elements. The first element, Connect,, aims to connect more customer workflows, industry life cycles,lifecycles, and solution offerings, so that we can continue to transform the way our customers work. This includes integrating more of our customers’ data through cloud offerings and making more of our solutions available over time on a subscription basis. When end users interact on aFor example, our flagship design and construction platform solution, Trimble Connect, enables entire project teams to collaborate in real-time between the office and the field to make efficient decisions around the same data-rich design model enhanced by our cloud capabilities. The second element, Scale raises the bar with shared, online platform, the overallon-demand services that empower network participants to proactively contribute to value that is created increases ascreation and delivery, directly and with fewer intermediaries. As the number of end-user participants increases. This network effect means thatend users increases, the willingness of developers, partners, orand additional end users to engage also increases, as the number ofcreating a network participants grows, whicheffect that further enhances the platform experience and end-user value. The second element, Scale, also aims to invest in the people, processes, and technologies that are necessary to streamline and standardize our internal processes, provide a seamless experience for our customers as they engage with our connected solutions, and enable us to continue to grow our business efficiently and effectively for many years into the future.

The global economy is experiencing a fundamental shift toward sustainability driven through broad stakeholder engagement, with a focus on decarbonization. Historically, through delivering productivity and efficiency gains, Trimble products have delivered sustainability for our customers, and we envision more opportunities to deliver expanded carbon reductions and other sustainability benefits, such as water management in agriculture and utilities, for our customers through Connect and Scale and the other elements of our strategy described below.

Additional elements of our long-term growth strategy include:

•Increasing focusFocus on software and services. Software and services targeted for the needs of vertical end markets are increasinglyincreasingly important elements of our solutions and are core to our growth strategy. We generally have an open application programming interface philosophy and open vendor environment, which leads to increased adoption of our software and analytics offerings. These software and services solutions integrate and optimize additional workflows for our customers, thereby improving their work productivity, and in the case of subscription, maintenance, and support services, also provide us with enhanced business visibility over time. Professional services constitute an additional customer offering that helps our customers integrate and optimize the use of our offerings in their environment.

•Focus onTargeting attractive markets with significant growth and profitability potential. We focus on large markets historically underserved by technology that offer significant potential for long-term revenue growth, profitability, and market leadership. Our core industries, such as construction, agriculture, and transportation, are each multitrillion dollar global industries that operate in demanding environments with technology adoption in the early phases relative to other industries.With the emergence of mobile and cloud computing capabilities, the increasing technological know-how of end users, and compelling return on investment, we believe many of our markets are attractive for substituting Trimble’s technology and solutions in place of traditional operating methods.

Proxy Statement for the 2022 Annual Meeting of Stockholders | Trimble 7

•Domain knowledge and technological innovation that benefit a diverse customer base.base. We have over time redefined our technological focus from hardware-driven point solutions to integrated work process solutions by developing domain expertise and heavily reinvesting in research and development and acquisitions. We currently have over 1,000 unique patents reflective of our technology portfolio and deep domain knowledge to deliver specific, targeted solutions quickly and cost-effectively to each of the vertical markets we serve. Our patent portfolio is continuously updated with new patent grants that emerge from our investments in research and development. We look for opportunities where the potential for technological change is high and that have a requirement for the integration of multiple technologies into complete vertical solutions.

•Geographic expansion with a localization strategy. We view international expansion as an important element of our strategy, and we continue to position ourselves in geographic markets that will serve as important sources of future growth. Trimble products are sold in more than 150 countries, through dealers, joint ventures, original equipment manufacturers (“OEMs”), and other channels throughout the world, as well as direct sales to end users. Sales are supported by our own offices located in over 40 countries around the world.

•Optimized go-to-market strategies to best access our markets. We utilize vertically focused go-to-market strategies that leverage domain expertise to best serve the needs of individual markets both domestically and abroad. These go-to-market capabilities include the use of independent dealers, joint venturessuch as with Caterpillar and Nikon, arrangements with OEMs, and distribution alliances with key partners, as well as direct sales to end users, which collectively provides us with broad market reach and localization capabilities to effectively serve our markets.

•4 Trimble | Proxy Statement for the 2024 Annual Meeting of Stockholders

Strategic acquisitions.acquisitions, joint ventures, and investments. Organic growth continues to be our primary focus, while acquisitions serve to enhance our market position. We acquire businesses that bring domain expertise, geographic presence, technology, products, and distribution capabilities that augment our portfolio and allow us to penetrate existing markets more effectively, or to establish a market beachhead.

•Venture fund investments. In 2021, we announced a newly formed strategic venture fund. With this fund, we expect to invest up to $200 millionOur success in early- to growth-stage companies that can accelerate innovationtargeting and effectively bring newintegrating acquisitions is an important aspect of our growth strategy. To further grow and position the Company, we partner with leaders in various fields by investing in early-to-growth stage companies through our venture fund and through strategic formation of joint ventures. In September 2023, we signed a definitive agreement to contribute our Trimble precision agriculture (“OneAg”) business, excluding certain Global Navigation Satellite System (GNSS) and guidance technologies, to a joint venture with AGCO, of which we will retain a 15% ownership stake. Trimble and AGCO’s shared vision is to create a global leader in mixed fleet smart farming and autonomy solutions that delivers on our collective strategy to better serve farmers with factory fit and aftermarket applications in the mixed fleet precision agriculture market. The transaction closed on April 1, 2024.

Sustainability. The global economy is experiencing a fundamental shift toward sustainability, driven through broad stakeholder engagement, with a focus on decarbonization. Historically, through delivering productivity and efficiency gains, Trimble products have delivered sustainability for our customers, and we envision more opportunities to deliver expanded carbon reductions and other sustainability benefits, such as water management in agriculture and utilities.

Guiding principles. To achieve Trimble’s long-term strategy, the industries that we servecompany’s core principles guide our employees’ actions and would give us an early, inside lookbehaviors and stake in emerging businesssupport the Connect & Scale strategy:

•Our operating system focuses on Strategy, People and technology solutions.

In support of our strategy, we have articulated a framework we call the Trimble Operating System, which calls on us to continually focus on the following three dimensions:

•breakout growth strategy, including Trimble Connect and Scale,

•extraordinary people, with an emphasis on fostering a diverse and inclusive work environment, and

•execution excellence, across both short-term and long-term horizons.

These build on and reinforce each otherExecution to create a high-performing organization.

•Our guiding values of “Be yourself and thrive together,” “Be intentional and humble,” and “Be curious and solve problems,” are the central, underlying philosophies that guide our interactions with each other and how we do business.

•Our guiding principles help us navigate and manage inherent complexities with ethical integrity, respect and teamwork.

•Our leadership principles drive us to inspire purpose and vision, engage to draw out the best from each other, and strive to achieve meaningful results.

Our Strategy for Sustainability

Overview

For more than 40 years, sustainability has been at the heart of who weWe are as a company. Positive sustainability impacts are woven into our work, realized both internally and through our customers’ application of our technology. Ensuringshaping a sustainable future is oneby living our values and working towards our mission of Transforming the defining issuesWay the World Works. Inspired by our mission, and fueled by the dedication of our generation,employees, we work to build momentum and current realities require even more accelerated focusstrive for continual improvement and increased ambitions for our strategic approach and process for managing the material environmental, social, and governance (ESG) aspects of our business.measurable progress. We believe our efforts, and the focus of our Board of Directors on environmental, social, and governance (“ESG”) issues, will make us a better and more resilient company, positioned to take on our most pressing environmental and social issues while creating even greater benefits for the customers and stakeholders we serve.

Our Sustainability program is integralThe Board ultimately oversees sustainability and ESG strategy, although each standing committee of the Board addresses various ESG matters and the charter of the Nominating and Corporate Governance Committee includes oversight regarding the Company’s strategies, programs, initiatives and policies for ESG matters. In fulfilling this role, the Nominating and Corporate Governance Committee engages with management on such matters, and develops and recommends to ensuring that we remain truethe Board corporate governance principles applicable to our missionthe Company and oversees the implementation of Transforming the Way the World Works while fulfilling our commitments to stockholders, people and planet. We organize our ESG efforts around the five pillars of Solutions, People, Communities, Environment, and Governance, which are described below. These pillars are reflective of our commitment to ESG and are fundamentally embedded into ourthese principles.

8 Trimble | Proxy Statement for the 20222024 Annual Meeting of Stockholders | Trimble 5

Sustainability Strategy

Sustainability is deeply integrated into our business strategy, threaded throughout our products and solutions and our people and culture. We believe this approach creates value that benefits all ofIt’s what guides our stakeholders,innovations and investments. It’s what drives us to build resilience for our company and our customers, to empower people, including our employees stockholders, customers, communities and planet.partners, and to lead with integrity in all that we do.

| | | | | | | | | | | | | | |

| Our Solutions. This pillar encompasses our customer solutions, which connect the digital and physical worlds to improve environmental sustainability, maximize productivity and ensure safety in the construction, transportation, geospatial and agricultural industries, among others. By transforming how the world’s work gets done, our solutions work to further our sustainability impact. Many of our solutions throughout our construction, agriculture and transportation businesses enable field work to be completed more productively, more efficiently and with less fuel usage, which results not only in cost savings to our customers, but also results in reduced greenhouse gas emissions. We also have solutions that help reduce the use of fertilizer and herbicide, protect water resources, and reduce scrap and rework on construction sites.

| |

Our People. This pillar addresses our commitment to providing every employee with the opportunity to learn, grow, and excel in a respectful and collaborative workplace. At the heart of our culture is a shared entrepreneurial spirit and growth mindset. We value diversity in all of its forms, knowing it makes us stronger and better able to solve complex problems for our customers.

| Environment. This pillar encompasses environmental stewardship, which isBuilding Resilience

•Drive, Enable, and Contribute to Decarbonization •Drive toward a fundamental aspect of our sustainability commitment. We are continually implementing new ways to measure and manage our environmental impact while developing new systems and practices used to capture value from our operations. We are particularly focused in the areas of responsible sourcing, product life cycle, measuring our carbon footprint and reducing our emissions and environmental impact.net-zero future |

| | | |

Communities. This pillar addresses our commitment to supporting numerous charitableEmpowering People

•Values: Belong, Grow, and educational organizations, encouraging our employees to become engaged in localInnovate •Key Pillars: Diversity, Equity, Inclusion, Leaders, and global volunteer efforts and fostering a diverse, next-gen workforce. We have established the Trimble Foundation, a donor-advised fund that focuses its charitable giving across three areas – disaster and climate resilience; female education and empowerment; and diversity, equity, and inclusion – while also supporting the philanthropic efforts of our local offices. Our Education and Outreach Programs support aspiring professionals and aim to create a diverse, next-gen workforce, through establishing Trimble Technology Labs, academic research funding, student scholarships and other resources.Communities | | Governance, EthicsLeading with Integrity

•Corporate and Compliance. This foundational pillar focuses on our adherence to sound corporate governance principals, ethics,Sustainability Governance •Ethical Business Practices •Privacy and compliance in all aspects of our business. Our Board of Directors sets high standards for our directors, officers, and employees, and for the conduct of our business worldwide. Our success is grounded in effective behavior that is based on demanding values. One such key value is the belief in an uncompromised ethical standard. We also maintain various compliance and training initiatives, including programs that address anti-bribery and anti-corruption, conflict minerals and supplier codes of conduct, environmental compliance, third party compliance and ethics, trade compliance and quality management systems.Cybersecurity |

2021Building Resilience. Building resilience is about enabling ourselves, our customers, and the essential industries we serve to adapt, grow, and thrive in the face of change. We continue to invest in innovation, research, and development in order to adapt, prepare, and expand capabilities that help transform our industries and accelerate toward a net zero future. In 2022, we received approval of our carbon reduction targets from the Science Based Targets initiative (“SBTi”), the predominant third-party net-zero target assessment entity. Our goals are consistent with requirements to keep global warming to 1.5°C in accordance with the Paris Climate Agreement.

Empowering People. Together, our diverse community of innovators and problem solvers creates opportunities for our employees, customers, and community members to thrive. We extend our commitment to empowering people in the communities where we do business, collectively addressing challenges in alignment with our values. As further described below in “Our Culture and People,” we are focused on building a welcoming, diverse, equitable, and inclusive workplace. We believe our diversity makes us stronger and better able to solve complex problems for our customers.

Leading with Integrity. We are dedicated to leadership principles that ensure excellence in all we do. Through transparency, good governance, and a deep commitment to sustainability and ethics, we continue operating from a strong foundation of integrity now and in the future.

2023 Sustainability Highlights — Progress on Climate Action

In 2023, Trimble has establishedmade progress on fulfilling our near-term science-based emissions reduction targets, as approved by the SBTi. The approved targets are as follows:

•Reduce absolute scopes 1 and 2 Greenhouse Gas (“GHG”) emissions by 50 percent by 2030 from a complete greenhouse gas2019 base year including achieving 100 percent annual sourcing of renewable electricity by 2025.

•Reduce absolute scope 3 GHG emissions inventory across Scopes 1, 2,(includes emissions from fuel and 3,energy-related activities, business travel, and hasupstream transportation and distribution) by 50 percent by 2030 from a 2019 base year.

•Commit to partner with 70 percent of our suppliers by emissions covering purchased goods and services and capital goods to set science-based targets that are currently under review by the Science Based Targets initiative. Our inventory2026.

Details on Trimble’s emissions reduction progress and science-based targets function together in providing rigorous measurement and accountability in achieving emissions reductions at the pace and scale demanded by scientific consensus. Through participation in voluntary climate disclosures in 2021 such as CDP, Trimble has continued to make progress on aligning our climate-related disclosuresroadmap, along with the consistent, comparable, clear, and reliable information called for by the Task Force on Climate-related Financial Disclosures (TCFD).

Morefurther information about Trimble’s sustainability efforts, includingcan be found in our Sustainability Report, with a SASB index,available at trimble.com/sustainability. (The information on our website is available at: www.trimble.com/en/our-commitment/overview.not incorporated by reference in this proxy statement.)

6 Trimble | Proxy Statement for the 20222024 Annual Meeting of Stockholders | Trimble 9

Our Culture and People

Trimble’sOur culture reflects our guiding principles at work and is fundamental to sustaining our success. That company culture is foundational to a thriving workplace; it is the behaviors and values of leaders and employees that are the foundation for who we are. At Trimble, we value being yourself and thriving together; being intentional and humble; and being curious and solving problems. Our employees leaders inspire purpose and vision, engage to draw out the best from each other, and strive to achieve meaningful results. This mindset shapes how we treat one another and how we serve our customers, colleagues, and stockholders. These attributes serve as a common foundation across the global organization and also adapt locally to diverse geographic and operational business models. Commitment to these behaviors unites Trimble employees.

We strive to make Trimble a diverse, equitable, inclusive, and safe workplace and provide opportunities for our employees to grow and develop in their careers, supported by competitive compensation, benefits, and health and wellness programs, and by programs that build connections between our employees and their communities. Our employees are working in over 200 locations in over 40 countries. Collectively, we speak more than 45 different languages.

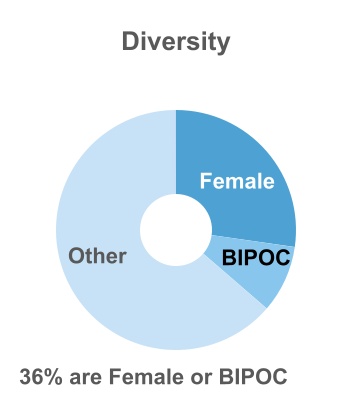

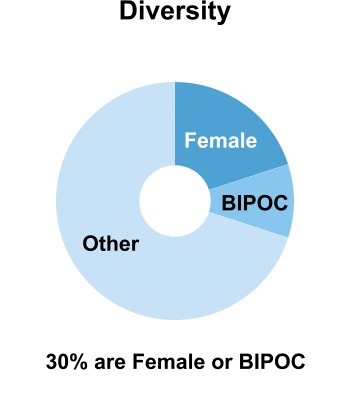

Diversity, Equity, and Inclusion (“DEI”)

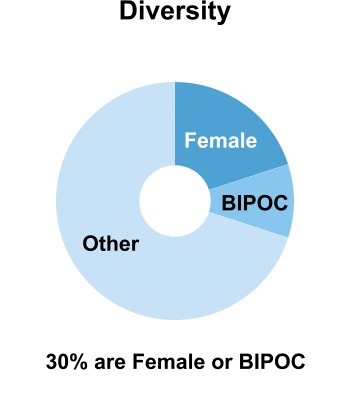

We value diversity in our workforce, including various cultures, backgrounds, ages, gender, racegenders, races and ethnicities, nationality,nationalities, sexual orientation, religion,orientations, religions, people with different abilities, parents and caregivers, and many other characteristics, knowing that it drives our best thinking. Our focus on diversity starts at the top. FourOur employees are working in around 200 locations in over 40 countries. Collectively, we speak more than 45 different languages. We believe our diversity makes us stronger and better able to solve complex problems for our customers. Three out of eleven of our currentten board members are female or ethnically diverse, placing usand we are making progress towards our goal of increasing global female employees and U.S. ethnically diverse employees in a select groupour workforce and in our leadership positions across the company.

A number of companies. In 2021, we activated many new initiatives focused on infusing diversity, equity, and inclusion (DEI) in the fabric of our connected culture. We have developed numerous employee resource networks exist in Trimble that enhance our inclusive and diverse culture, including networks that support women, caregivers, Black, Hispanic/Latinx and Indian professionals, veterans, employees with disabilities, and our LGBTQ+ community.

In 2023, we continued our investments in community partners by serving as a Board of Corporate Affiliates sponsor for the National Society of Black Engineers, sponsoring Out & Equal, a non-profit organization working on LGBTQ+ workplace equality, and increasing our presence at events like AfroTech and Colorado Technology Association’s Women in Tech annual summit.

More information about Trimble’s DEI efforts, including our 2022 DEI Report with our 2025 goals, is available at: trimble.com/diversity-and-inclusion. (The information on our website is not incorporated by reference in this proxy statement.)

Compensation and Benefits

We believe people should be paid for the role they perform and their skills and experience, regardless of their gender, race, age, or other personal characteristics. To deliver on that commitment, we set pay ranges based on market data and factors such as an employee’s role, their experience, their performance, and the region in which they live. We also regularly review our compensation practices to ensure our pay is fair and equitable. In addition to base salaries, certain roles are eligible to participate in short-term and long-term incentive plans.

We offer market-competitive benefit programs (that vary by country/region), which include health and wellness benefits, life insurance and disability benefits, flexible savings accounts, paid time off, parental and family leave, employee support programs, retirement plans, and an employee stock purchase plan. Other benefits include fertility, adoption, and surrogacy education assistance; gender affirmation, family and caregiver support; flexible work arrangements; education assistance; and on-site services such as health centers and fitness centers at some sites.

Talent Development and Building Connections

We are focusedcommitted to providing every employee with the opportunity to learn, grow, and excel in a respectful and collaborative workplace. Through our internal global talent platform, we empower employees to identify internal job opportunities, skill development resources, and projects to achieve their personal development goals and full potential. We encourage employees to nurture a love of continuous learning and resilience that is essential for accomplishment.

Proxy Statement for the 2024 Annual Meeting of Stockholders | Trimble 7

We believe that building connections between our employees, their families, and our communities creates a more meaningful, fulfilling, and enjoyable workplace. In our offices around the world, our employee-led committees select local organizations to support, often in the form of grants and employee fundraising.

Our Trimble Foundation Fund aligns international philanthropic efforts by giving back to the communities where Trimble does business and helping those in need. The Trimble Foundation Fund focuses on measuringthree key areas within our communities (i) Disaster and increasing gender representation, as well as raceClimate Resilience, (ii) Female Education and ethnic diversity in high-impact roles such as front-line management, engineering, product management,Empowerment, and sales.(iii) Advancing Diversity, Equity, and Inclusion.

Health, Safety, and Wellness

The success of our business is fundamentally connected to the well-being of our people. Accordingly, we are committed to the health, safety, and wellness of our employees. We have provided increasedprovide our employees and their families with access to DEI educational resources, training, assessments, and other employee forums to help us work together globally and more effectively across a variety of culturesinnovative, flexible, and perspectives. We believe our diversity makes us strongerconvenient health and better ablewellness programs that offer choice where possible, so they can customize their benefits to solve complex problems for our customers.meet their needs and the needs of their families.

Corporate Governance Highlights

Corporate Governance Framework

Our Board of Directors recognizes that Trimble’s success over the long term requires a strong corporate governance framework. Below are highlights of our corporate governance framework:

•Our directors are elected annually.We actively engage our stockholders for feedback.

•We separate the positions of Executive Chairman of the Board, CEO and Lead Independent Director, which provides a balance inrecently adopted an amendment to our leadership structure and helps ensure a strong, independent and active Board.

•In uncontested elections, our directors must be elected bybylaws to adopt a majority voting standard for the election of directors, changed from a plurality voting standard (contested elections will continue to be governed by plurality voting).

•In the votes cast, and an incumbent director who fails to receiverecent amendment of our bylaws, we added a majority is required to tender his or her resignation.provision giving stockholders a proxy access right.

•We have no supermajority voting requirementsrequirements.

•Our Board of Directors has an independent chairperson (since the retirement of Steve Berglund in May 2023, and the subsequent appointment of Börje Ekholm as chairperson).

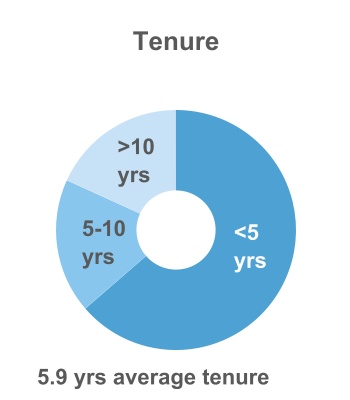

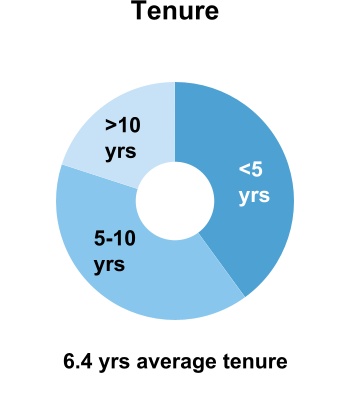

•We focus on board refreshment and diversity. More than half of our Certificatedirectors have less than five years of Incorporation current tenure and a third of our directors are female and/or Bylaws.ethnically diverse.

•We have stock ownership guidelines for our non-employee directors (and a stock ownership policy applicable to our executive officers, including our CEO).

•We have established a succession planning process and we actively plan for executive succession on an ongoing basis, as demonstrated by the successful transition of both our new CEO and CFO into their roles in 2020.basis.

•We have double triggerno single-trigger full vesting arrangements upon a change in control, arrangements for new equity issuances, withand no excise tax gross‑up.

•We have stock ownership guidelinesThe Board of Directors has overall responsibility for the oversight of risk management for the Company.

•The Board of Directors oversees cybersecurity risk at the Company, with the Audit Committee receiving regular updates on cybersecurity risk management.

•Oversight of the Company's financial matters and related risks lies with the Audit Committee.

•In setting compensation, our non-employee directors and a stock ownership policy applicablePeople & Compensation Committee considers the risks to our stockholders and the Company as a whole.

•The Company's corporate governance principles are overseen by the Nominating and Corporate Governance Committee and set forth in our publicly available Corporate Governance Guidelines.

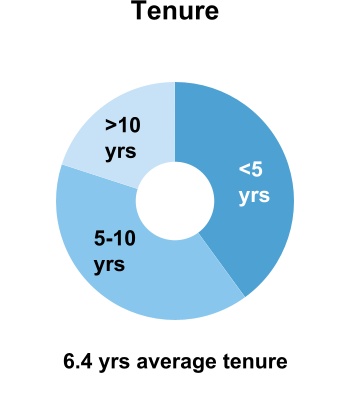

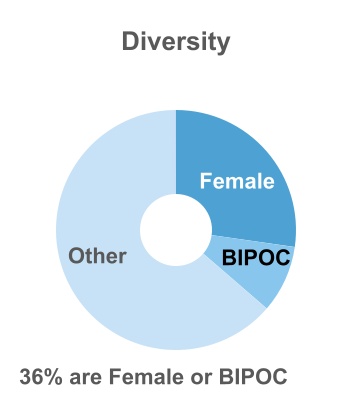

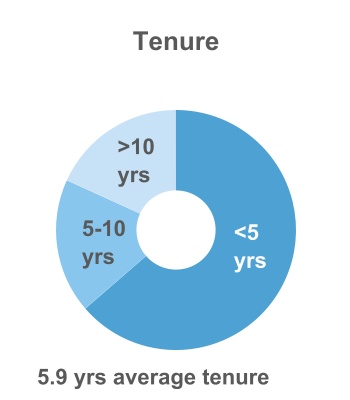

Board Diversity

Our Board strives to maintain a diversity of membership. The composition of our Board was affected in the past year by the resignation of Ann Fandozzi, who left the Board in February of this year to spend more time in her new role as CEO of Convergint, and the death of Sandra MacQuillan, who passed away in April 2023, in addition to the retirement of Steven Berglund, who retired from the Board and from his executive officers, includingrole with the Company, effective as of the Company’s 2023 annual meeting of stockholders. Earlier this year, the Board appointed Kara Sprague and Ron Nersesian to serve as directors, who both joined the Board effective February 5, 2024. The Board Diversity Matrix set forth below provides information as of April 1, 2024 (for purposes of the matrix and related chart, tenure includes both current service and any previous service on the Board). To view our Named Executive Officers.

•We actively engage our stockholders for feedback.Board Diversity

10 8 Trimble | Proxy Statement for the 20222024 Annual Meeting of Stockholders

•We focusMatrix as of April 1, 2023, please see our prior proxy statement filed with the U.S. Securities and Exchange Commission (the “SEC”) on board diversity and refreshment, as evidenced by the fact that four out of eleven of our directors are female or ethnically diverse (black, indigenous and peoples of color, or “BIPOC”), and seven out of eleven of our directors have less than five years of tenure.April 18, 2023.

| | | | | | | | | | | | | | |

| Board Diversity Matrix (as of March 28, 2022) |

| Total Number of Directors: | 11 |

| Diversity | Female | Male |

| Gender Identity | 3 | 8 |

| Demographic Background: | | |

| | African American or Black | 0 | 1 |

| | White | 3 | 7 |

| Tenure | | |

| <5 years | 7 |

| 5-10 years | 2 |

| >10 years | 2 |

| | | | | | | | | | | | | | |

| Board Diversity Matrix as of April 1, 2024 |

| Total Number of Directors: | 10 |

| Diversity | Female | Male |

| Gender Identity | 2 | 8 |

| Demographic Background: | | |

| | African American or Black | 0 | 1 |

| | White | 2 | 7 |

| Tenure | | |

| <5 years | 4 |

| 5-10 years | 4 |

| >10 years | 2 |

We believe that our directors are highly qualified and well suited to providing effective oversight of our continuously evolving business, and that they provide our Board of Directors with a balance of critical skills and an effective mix of experience and expertise, as summarized below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skills & Attributes | Number of Directors |

| | | | | | | | | | | | |

| Leadership | Demonstrated understanding of essential leadership qualities; ability to develop leadership potential in others and effectively implement transformational change within organizations | | | | | | | | | | | 1110 |

| Innovation | Experience with innovative technologies and their development and deployment; understanding of relevant technological trends and their disruptive potential | | | | | | | | | 9 | | | | | | | | | | 11

|

| Domain Expertise | Understanding of the industries we serve, including market dynamics, customer workflows, and developing trends

| | | | | 5 | | | | | | 7 | | | | |

| Global Business | Experience with international dynamics and complexity, multinational operations, and the development of international relationships and opportunities | | | | | | | | 8 | | | | | | | | 9 | | |

| Go To Market | Understanding how to optimally bundle, launch, market and distribute new solutions to deliver compelling value to customers | | | | | | 6 | | | | | 6 | | | | | |

| Financial Expertise | Knowledge of financial accounting and reporting, financial markets, and finance operations and management, including capital deployment | | | | | | 6 | | | | | | | 8 | | | |

| Strategic Transactions | Familiarity with driving business transformation through M&A, strategic alliances, investments, and significant commercial partnerships | | | | | | 6 | | | | | | | 8 | | | |

| Sustainability | Experience with ESG initiatives, frameworks and trends, including long-term sustainability and value creation, diversity and inclusion, or public company governance oversight | | | | | | | | | 9 | | | | | | | | | 10 | |

| | | | | | | | | | | | |

Proxy Statement for the 2024 Annual Meeting of Stockholders | Trimble 9

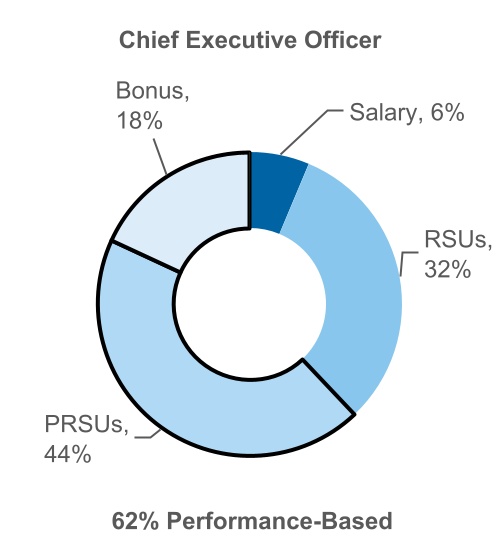

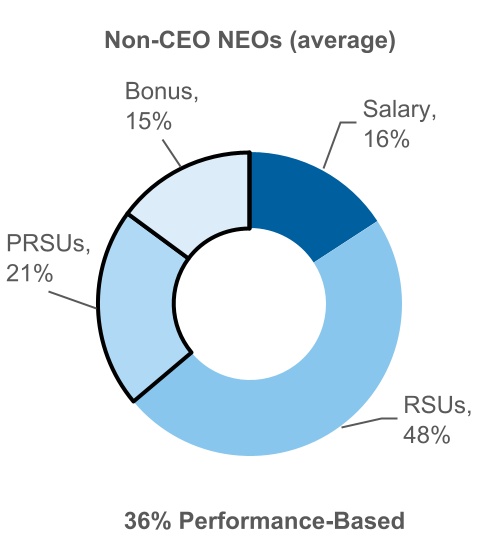

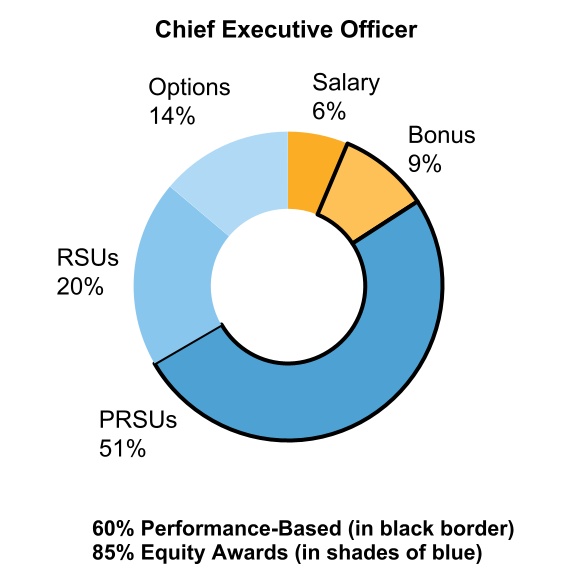

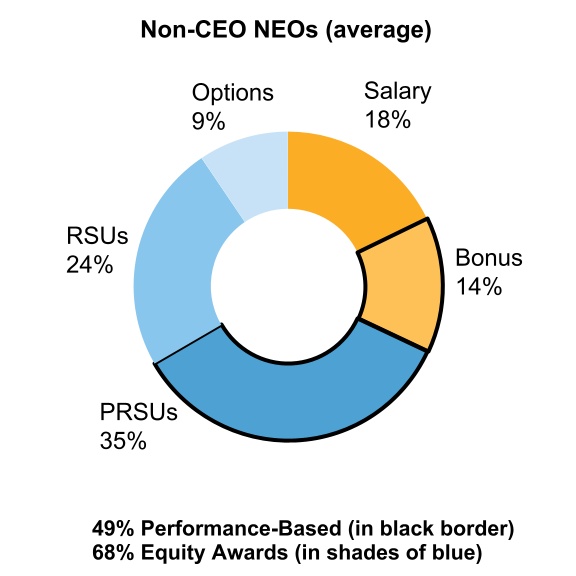

Executive Compensation Philosophy, Policies and Practices

Our executive compensation philosophy is based on our continuing effortobjective of attracting and retaining exceptional people and fosteringfostering and supporting a pay-for-performance culture. We have designed our executive compensation programsprogram to closely align with the interestinterests of our stockholders. As discussed in detail under “Compensation Discussion and Analysis” later in this proxy statement, ourA substantial portion of executive compensation program

Proxy Statement for the 2022 Annual Meeting of Stockholders | Trimble 11

provides short-term cash and long-term equity components,is “at risk” based on our performance, with a significant weight toward long-term equity awards tied closely to stockholder returns and long-term objectives.

Key Policies and Practices

The following summarizes someobjectives. Our executives are required to hold a minimum ownership level of our keycommon stock and are prohibited from engaging in hedging or pledging activities with our common stock. Our compensation programs are designed without incentives to take excess risk, and executive compensation is subject to a “clawback” policy, which allows for the recovery of certain compensation in the event of a material restatement of our financial results or certain misconduct by an executive officer.

As discussed in detail under “Compensation Discussion and Analysis” later in this proxy statement, we provide only very-limited executive-only benefits, with no special pension arrangements or retirement plans (although we do have an Age & Service Equity Vesting Program, described therein). We provide no significant perquisites or other personal benefits for our executive officers, other than an annual executive physical exam, and no tax reimbursements or “gross up” payments, other than related policies and practices:

| | | | | |

What we do |  What we don’t do |

•Use a pay-for-performance philosophy

•Maintain an independent compensation committee

•Retain an independent compensation advisor

•Review executive compensation and conduct an overall compensation risk assessment annually

•Place compensation “at risk,” with a majority of executive compensation in the form of performance-based incentives

•Maintain a stock ownership policy that requires our CEO and executive officers to hold a minimum ownership level of our common stock

•Maintain a “clawback” policy, which in the event of a material restatement of our financial results, allows for the recovery of certain compensation from our executive officers.

•Hold an annual stockholder advisory vote on executive compensation

| •No executive-only pension arrangements or retirement plans (although certain eligible executives may participate in the Age & Service Equity Vesting Program as described below)

•No significant perquisites or other personal benefits for our executive officers

•No tax reimbursements or “gross up” payments, other than related to standard relocation benefits

•No special health or welfare benefits for executives

•No hedging or pledging of our equity securities

•No stock option re-pricing

•No single-trigger change-in-control arrangements for equity issuances

|

to standard relocation benefits.Stockholder Engagement

Trimble’s Board of Directors values the opinions of our stockholders and carefully considers feedback received with regard to our governance practices, executive compensation program, and management of key ESG topics. Over the past several years, our management team has engaged with stockholders to better understand their views regarding our approach to executive compensation. In recent years, we have made changes to our executive compensation programsprogram in response to this input and based upon our ongoing review of best practices. These changes have included:

•Adopting a clawback policy, and updating the policy in 2023 to align with new rules regarding mandatory recovery of erroneously awarded compensation in the event of an accounting restatement, along with discretionary recovery of certain compensation in the event of misconduct leading to the need for an accounting restatement

•Extending stock ownership guidelines to our CFO and Named Executive Officers

•Eliminating quarterly performance periods for executive bonus plans

•Eliminating all single-trigger full vesting in connection with new equity issuancesa change in control

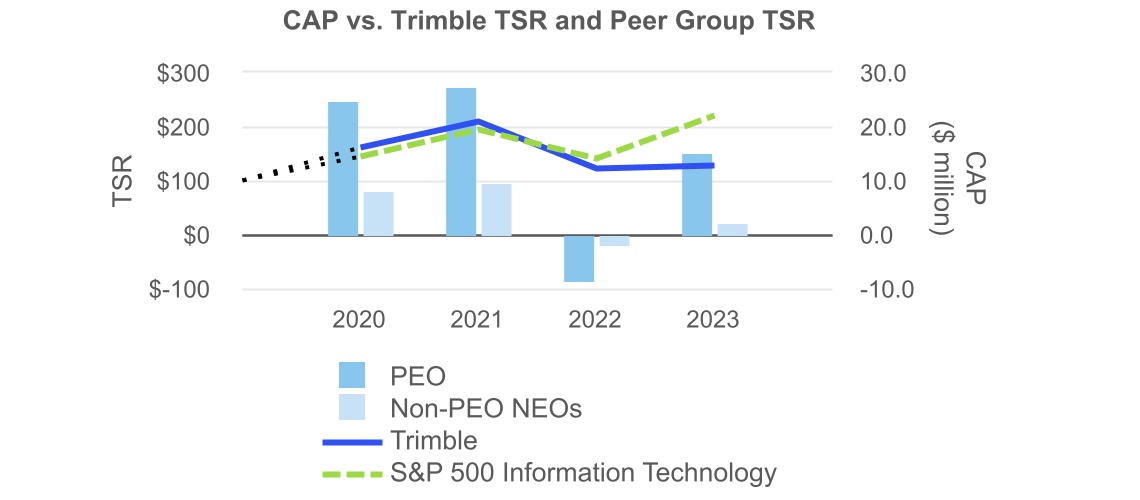

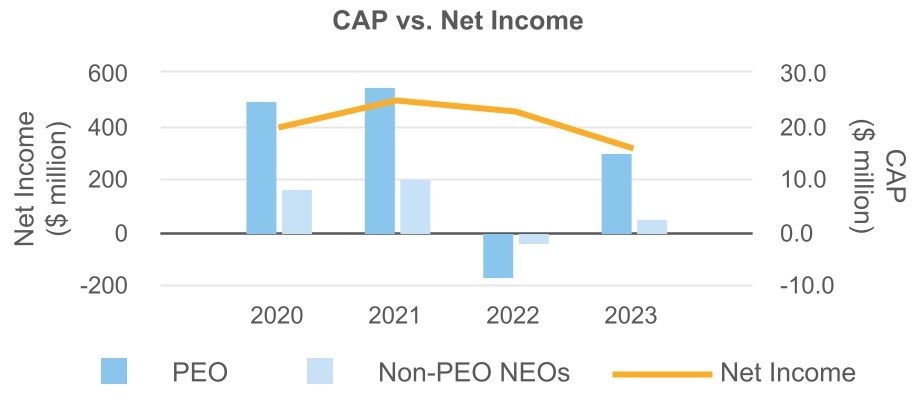

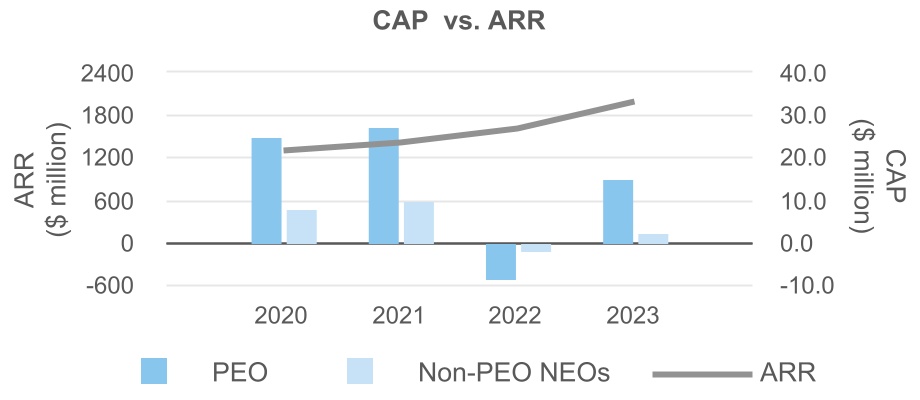

•Increasing the stock ownership guidelines for the members of our Board and our executive officers